OK2Pay Process

OK2Pay Overview

OK2Pay ensures your payments reach the correct payee by verifying the payee's bank account details before any transaction is processed. This verification provides confidence and reduces the risk of misdirected payments.

A payee is also known as a Supplier / Vendor but we will refer to as a Payee in the documentation

Adding a New Payee

When you add a new payee, the payee will receive a secure link via email to perform the following verifications:

- Verifiy Company Details: Confirm company details like ABN and contact details.

- Upload a Bank Statement:

- OPTION 1 - EXPRESS STATEMENT

The Payee logs in to their bank account and via a secure process their account details extracted for verification. This is very secure, it does not store any banking or user details and fully encrypted. It does provide the best form of authenticity of the banking details. - OPTION 2 - UPLOAD STATEMENT

The Payee will need to upload a bank statement as a PDF. This will redact on uploading and give the Payee an option to via redactions before submitting. Ideally 2 bank statements from different periods that is not more that 6 months old should be uploaded. These cannot be a bank letter, photo, scanned as these formats can easily be manipulated. If only 1 document is uploaded, this may require extra checks and also might result in non-approval (rejection) as the authenticity cannot be validated.

- OPTION 1 - EXPRESS STATEMENT

- Additional Information: The Payee may be required to confirm, answer or provide some additional information via a questionnaire. These questions are setup by the customer.

Once the Bank Statement data has been received, OK2Pay will then perform an 8-step verification process to confirm the authenticity and ownership of the bank account.

If the Payee doesn't respond within the Expiry Date which is set (typically set to 5 days), this can be extended for a furhter period, else the link will expire and the process will need to be restarted.

NOTE: ONCE BANK STATEMENTS ARE VERIFIED BY THE CUSTOMER, THEY ARE DELETED FROM THE APPLICATION

Verification Outcomes

Once OK2Pay completes the verification:

- The payee will either be approved or rejected.

- You, the customer, can review OK2Pay’s findings and choose to accept or reject the payee.

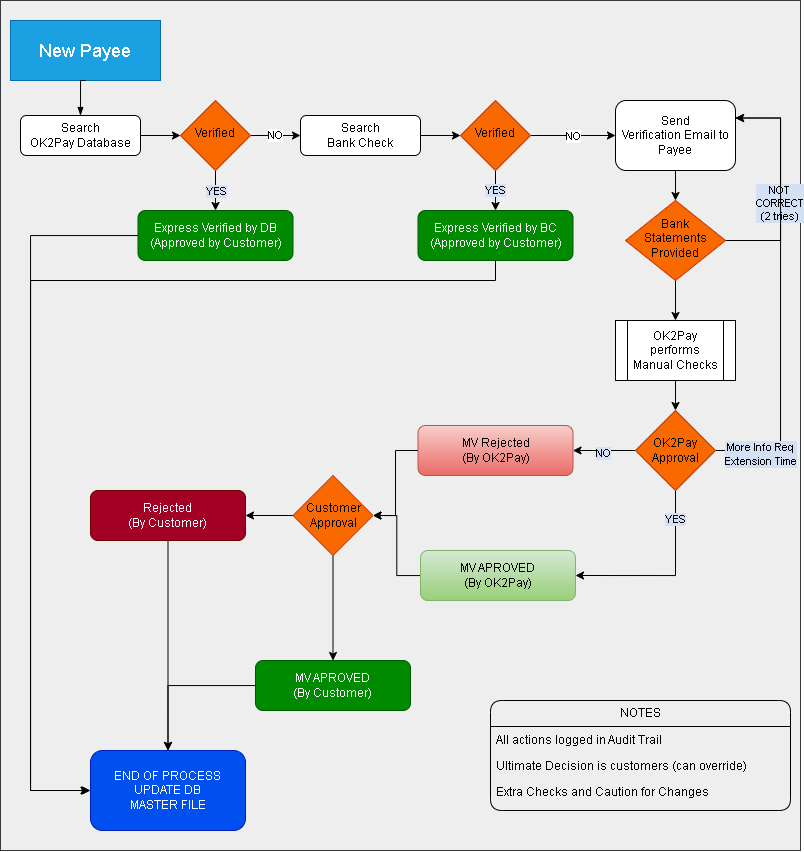

Below is the workflow for a New Payee

8-Step Verification Process

OK2Pay employs a rigorous 8-step verification process to:

- Validate the company details

- Validate the contact details

- Authenticate bank account ownership.

- Authenticate the Bank Statement

- Ensure compliance with industry standards for account verification.

This robust process maximises confidence in the verification results and safeguards your financial transactions.

Ok2Pay may reject a verification if a payee information does meet the criteria. The customers will be kep t upadte with the process and reason and has the ultimate decision to verfify/reject the bank details of the payee.

By integrating OK2Pay into your payment workflow, you gain an added layer of security and reliability for your supplier payments.